Funding Pips: Prop & Cons

Analyzing this company, we noticed that the number of advantages of cooperation with it significantly exceeds the number of disadvantages. However, the latter are also present and should be paid special attention to.

Pros

- +Impressive Trustpilot rating of 4.6/5.

- +Three Distinctive Funding Programs.

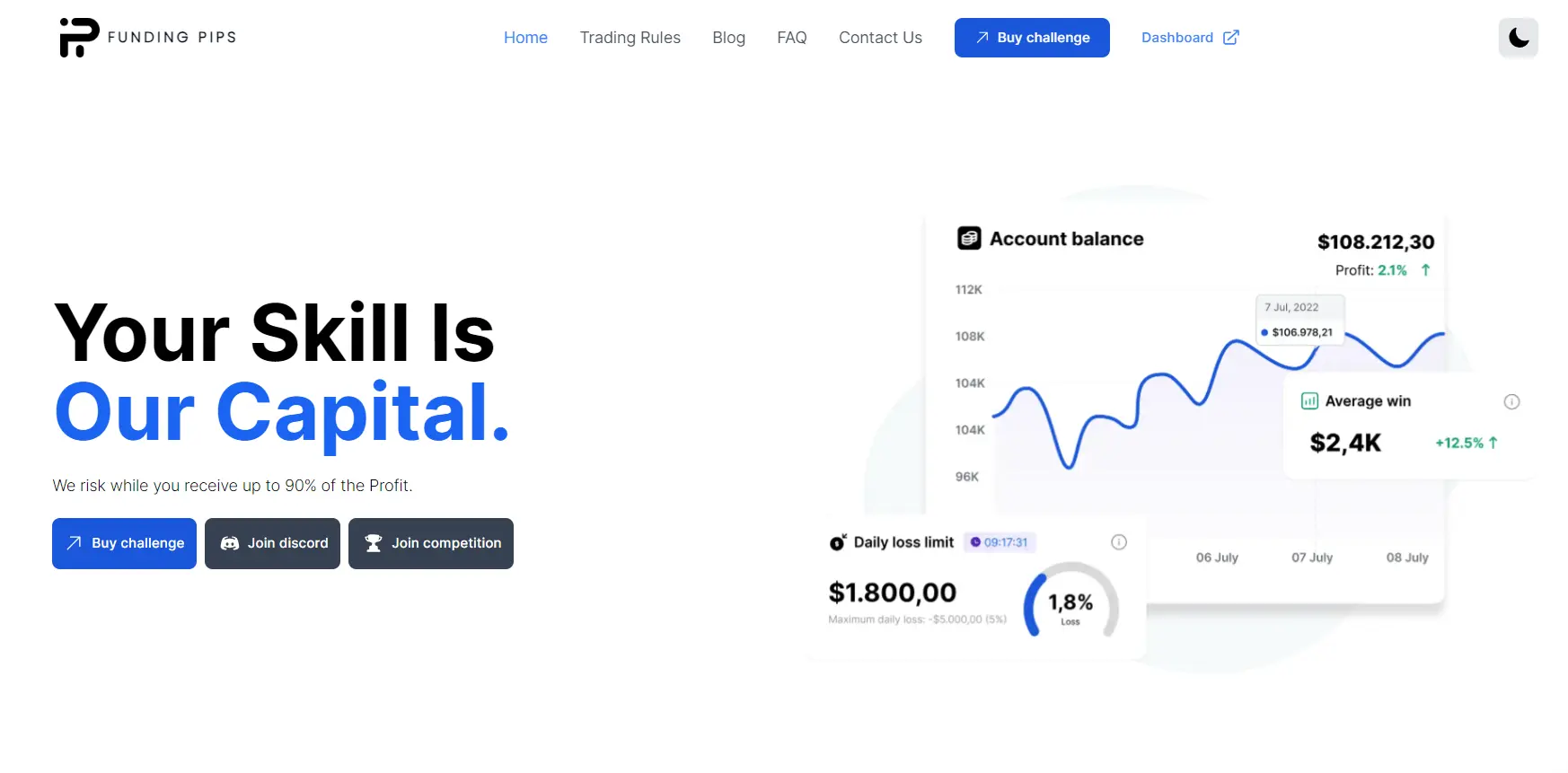

- +Advanced Trader Dashboard.

- +A wide range of trading instruments is available, including forex pairs, commodities, indices, and cryptocurrencies.

- +Maximize your leverage with a ratio of 1:100.

- +No limits or restrictions Requirements for a Successful Trading Day.

- +Plan for Scaling.

- +Flexible Daily & Peak Loss.

- +Significant Decrease in Investment Value up to 14%.

Cons

- -The evaluation program experiences drawdowns that are based on equity.

- -1% Withdrawal Requirement.

- -No hedging allowed.

Who are Funding Pips?

Funding Pips is an exclusive trading firm founded in 2022, based in the vibrant city of Dubai, UAE. Funding Pips has established itself as a reputable trading company committed to empowering traders. The company offers an initial package starting at $5,000, with a maximum cap of $100,000, which has the potential to be increased up to $2,000,000. Traders have the option to open numerous accounts, each with a maximum allocation of $400,000. Funding Pips offers a comprehensive approach to assisting with trading.

Funding Pips brokers is a newly formed proprietary trading firm that operates in the forex market. Traders are provided with the chance to maximize their capital efficiently. Aside from forming strategic alliances for software solutions, Funding Pips boasts an internal engineering team dedicated to improving the trading experience.

In this Funding Pips review, you’ll learn that company provides a wide range of funded trading accounts, encompassing different trading instruments such as forex pairs and cryptocurrencies. Funding Pips prop firm offers access to funded accounts at incredibly affordable entry options, starting from as low as $32. Traders who consistently show profitability have the opportunity to qualify for the firm’s scaling plan. This plan can boost their account balance up to 20% of the original amount.

Who is the CEO of Funding Pips?

Khaled Ayesh is the Chief Executive Officer of Funding Pips. It is worth saying that Khaled himself is a professional forex trader. His main goal was to create a company from traders to traders, which would provide everyone with the best conditions of cooperation in the market.

Funding Pips of Key Features

Funding Pips prop firm is famous among traders primarily because of its key features. Here are just a few of them that you should pay special attention to:

- Weekly Payouts: Funding Pips prop firm offers the convenience of weekly withdrawals, ensuring a consistent influx of funds into traders’ accounts and keeping them motivated to stay dedicated to their trading activities. Moreover, these frequent withdrawals provide traders with the convenience of accessing their funds at more regular intervals than alternative platforms.

- Exciting Scaling Plan: Funding Pips provides a flexible scaling plan, enabling you to maximize your profits on the platform. According to this proposal, the company will boost your trading account balance by up to 20% based on your trading performance. Funding Pips brokers strongly encourages all traders to actively participate in trading in order to be eligible for the scaling plan and enhance their returns from the platform.

- Endless Trading Days: Traders are given ample time to grasp the complexities of trading and follow trading Funding Pips rules with precision. The prop firm does not enforce any limitations on the minimum or maximum number of trading days. This method allows you to have complete control over your trading speed, giving you the opportunity to maximize the benefits of your trades in the forex market.

- Profit Sharing: Funding Pips offers a profit-sharing program that allows you to potentially earn up to 80% of the profits generated from your trades. This is one of the most generous profit-sharing schemes available in the forex market. Traders have the opportunity to receive a substantial portion of their earnings, which helps to foster the expansion of their trading accounts.

Funding Pips: General Information

Next in our Funding Pips review, we offer a discussion of the main features of this company:<.p>

| Found in | 2022 | CEO | Khaled Ayesh | Account Currencies | USD | Account Size | $10,000, $100,000, $25,000, $5,000, $50,000 | Profit Sharing | up to 80% | Min. Deposit | $32 | Tradable instruments | Metals, Commodities, Crypto, Forex, Indices | Deposit Methods | BTC, Visa | Withdrawal Methods | BTC, Bank Transfer, Rise | [email protected] | Languages That Are Supported | English, Arabic, Dutch, Hindi, French, Spanish |

|---|

Is Reliable & Legal Funding Pips Prop Company?

Funding Pips has garnered a reputation as a reputable prop trading firm, as evidenced by numerous positive reviews and user feedback. Customers have expressed their satisfaction on platforms such as Trustpilot, highlighting seamless experiences, excellent trading conditions, and reliable support from the company. Despite a few setbacks in the review, KYC, and onboarding procedures following phase 2, the general attitude towards Funding Pips remains optimistic.

Legal/Licence

Funding Pips is a trustworthy funding platform that links entrepreneurs and small business owners with prospective investors. The company has a comprehensive screening procedure for both investors and businesses, guaranteeing that all parties involved are reliable. In addition, Funding Pips brokers provides a range of resources and assistance to aid businesses in their growth and success, making it an invaluable asset for those in search of funding.

Reputation

To date, not a single serious case has been identified that would negatively affect this company’s impeccable reputation in customers’ eyes.

Safe

Every day, the company invests more in modern data encryption technologies and other ways to protect clients’ information and funds. That’s why, with this firm, you can fully concentrate on trading without thinking about security.

What Makes Funding Pips Different From Other Prop Firms?

Funding Pips sets itself apart by offering a wide range of options to cater to individual trading preferences. Traders at Funding Pips have the opportunity to engage in trading activities amidst significant news events and maintain open positions overnight and even throughout weekends. Nevertheless, the use of martingale or hedging strategies is not allowed, and traders with funded accounts are required to establish a stop-loss within the first 30 seconds of a trade. Funding Pips provides traders with a profit split that varies between 80% and 90% by collaborating with Black Bull Markets.

In contrast to other similar platforms, Funding Pips provides traders with a unique two-stage evaluation process to determine their eligibility for payouts. In the initial stage, the aim is to reach a profit target of 8%, which will then be followed by a shift to a 5% target in the subsequent phase. Both stages have a maximum daily loss threshold of 5% and an overall cap of 10% for total losses. There are no set limits on the number of trading days required in either evaluation phase. The evaluation programs at Funding Pips include:

- A growth strategy.

- Offering achievable profit goals without strict day trading limits.

- Providing clear trading guidelines.

Funding Pips: Challenge Funding Program Options

Funding Pips offers traders three distinct funding program choices:

- Two-step Evaluation

- One-step Evaluation

- Three-step Evaluation

Two-step Evaluation

The Funding Pips Two-step Evaluation offers traders the chance to control account sizes that range from $5,000 all the way up to $100,000. The goal is to find skilled traders who are successful and can effectively handle risk during the two-step evaluation process. The Two-step Evaluation enables you to engage in trading with leverage of up to 1:100.

- Size of the Account

- Price

- $5,000: $36

- $10,000: $66

- $25,000: $156

- $50,000: $266

- $100,000: $444

In the first evaluation phase, traders must achieve an 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss regulations.

Regarding time constraints, it’s important to mention that there are no specific minimum or maximum trading day obligations in phase one. In order to move on to the next stage, all you need to do is achieve the 8% profit goal without surpassing the daily or overall loss limits.

In the second evaluation phase, traders must achieve a profit goal of 5% without exceeding their maximum daily loss of 5% or maximum loss limit of 10%. Regarding time restrictions, please be aware that there are no specific minimum or maximum trading day obligations in phase two. In order to achieve funded status, all you need to do is meet the 5% profit goal without exceeding the daily maximum or maximum loss limits.

After completing both evaluation phases, you will be granted a funded account with a minimum withdrawal threshold of 1% of your initial account balance. You must adhere to the guidelines of the 5% daily loss limit and the 10% maximum loss rule.

You can request your initial payout from your funded account once you generate a profit on the first Tuesday. Subsequently, you can also request payouts every Tuesday, provided that you meet all the requirements. You will receive a profit split ranging from 80% to 90%, depending on the profit generated from your funded account.

Two-step Evaluation Scaling Plan

Two-step Evaluation also includes a plan for scaling up. You will be granted an account boost along with increases in daily and maximum drawdowns, which will be determined by the number of payouts you successfully qualify for and the profit you have earned while being funded.

Is Reliable & Legal Funding Pips Prop Company?

Funding Pips has garnered a reputation as a reputable prop trading firm, as evidenced by numerous positive reviews and user feedback. Customers have expressed their satisfaction on platforms such as Trustpilot, highlighting seamless experiences, excellent trading conditions, and reliable support from the company. Despite a few setbacks in the review, KYC, and onboarding procedures following phase 2, the general attitude towards Funding Pips remains optimistic.

Legal/Licence

Funding Pips is a trustworthy funding platform that links entrepreneurs and small business owners with prospective investors. The company has a comprehensive screening procedure for both investors and businesses, guaranteeing that all parties involved are reliable. In addition, Funding Pips brokers provides a range of resources and assistance to aid businesses in their growth and success, making it an invaluable asset for those in search of funding.

Reputation

To date, not a single serious case has been identified that would negatively affect this company’s impeccable reputation in customers’ eyes.

Safe

Every day, the company invests more in modern data encryption technologies and other ways to protect clients’ information and funds. That’s why, with this firm, you can fully concentrate on trading without thinking about security.

What Makes Funding Pips Different From Other Prop Firms?

Funding Pips sets itself apart by offering a wide range of options to cater to individual trading preferences. Traders at Funding Pips have the opportunity to engage in trading activities amidst significant news events and maintain open positions overnight and even throughout weekends. Nevertheless, the use of martingale or hedging strategies is not allowed, and traders with funded accounts are required to establish a stop-loss within the first 30 seconds of a trade. Funding Pips provides traders with a profit split that varies between 80% and 90% by collaborating with Black Bull Markets.

In contrast to other similar platforms, Funding Pips provides traders with a unique two-stage evaluation process to determine their eligibility for payouts. In the initial stage, the aim is to reach a profit target of 8%, which will then be followed by a shift to a 5% target in the subsequent phase. Both stages have a maximum daily loss threshold of 5% and an overall cap of 10% for total losses. There are no set limits on the number of trading days required in either evaluation phase. The evaluation programs at Funding Pips include:

- A growth strategy.

- Offering achievable profit goals without strict day trading limits.

- Providing clear trading guidelines.

Funding Pips: Challenge Funding Program Options

Funding Pips offers traders three distinct funding program choices:

- Two-step Evaluation

- One-step Evaluation

- Three-step Evaluation

Two-step Evaluation

The Funding Pips Two-step Evaluation offers traders the chance to control account sizes that range from $5,000 all the way up to $100,000. The goal is to find skilled traders who are successful and can effectively handle risk during the two-step evaluation process. The Two-step Evaluation enables you to engage in trading with leverage of up to 1:100.

- Size of the Account

- Price

- $5,000: $36

- $10,000: $66

- $25,000: $156

- $50,000: $266

- $100,000: $444

In the first evaluation phase, traders must achieve an 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss regulations.

Regarding time constraints, it’s important to mention that there are no specific minimum or maximum trading day obligations in phase one. In order to move on to the next stage, all you need to do is achieve the 8% profit goal without surpassing the daily or overall loss limits.

In the second evaluation phase, traders must achieve a profit goal of 5% without exceeding their maximum daily loss of 5% or maximum loss limit of 10%. Regarding time restrictions, please be aware that there are no specific minimum or maximum trading day obligations in phase two. In order to achieve funded status, all you need to do is meet the 5% profit goal without exceeding the daily maximum or maximum loss limits.

After completing both evaluation phases, you will be granted a funded account with a minimum withdrawal threshold of 1% of your initial account balance. You must adhere to the guidelines of the 5% daily loss limit and the 10% maximum loss rule.

You can request your initial payout from your funded account once you generate a profit on the first Tuesday. Subsequently, you can also request payouts every Tuesday, provided that you meet all the requirements. You will receive a profit split ranging from 80% to 90%, depending on the profit generated from your funded account.

Two-step Evaluation Scaling Plan

Two-step Evaluation also includes a plan for scaling up. You will be granted an account boost along with increases in daily and maximum drawdowns, which will be determined by the number of payouts you successfully qualify for and the profit you have earned while being funded.

Trading Instruments

In order to suit a wide variety of trading techniques, the Funding Pips prop company offers a comprehensive selection of derivative trading instruments. Trading opportunities are available to traders acrossa variety of marketplaces, including the following:

- Traders are able to capitalize on global economic trends and geopolitical events by trading foreign exchange pairings. Funding Pips provides a wide variety of major, minor, and exotic currency pairs.

- Trading in commodities: Traders have the opportunity to actively participate in the commodities market, which includes precious metals like gold and silver, as well as energy commodities like crude oil.

- Indexes: Traders have access to a wide range of global indexes, which gives them the ability to bet on the performance of major stock markets all over the world.

- Funding Pips provides users with the chance to trade prominent digital assets such as Bitcoin, Ethereum, and Ripple. This is in response to the rising demand for cryptocurrencies, which Funding Pips has recognized.

Trading Platforms

A platform that is recognized for its configurable charts, technical indicators, real-time market news, and a variety of order types is the MetaTrader 5 (MT5) platform, which is the only platform that Funding Pips exclusively employs. MT5 is available on a variety of devices, making it convenient for traders to obtain. This adaptability extends to a wide range of devices, including desktop computers, laptops, cell phones, and tablets, among others. This guarantees that traders are able to effortlessly access their accounts and make deals, regardless of where they are located geographically.

Trading Fees

In order to make big profits, traders need to pay attention to the trading commissions offered by the company. In the case of Funding Pips, these commissions are quite loyal. Let’s look at them further in the Funding Pips brokers review:

- Asset

- Fees for Commission

- FOREX: 2 USD / LOT

- COMMODITIES: 2 USD / LOT (0 USD / LOT on Oil)

- INDICES: 0 USD / LOT

- CRYPTO: 0 USD / LOT

Funding Pips: Step-by-Step Account Opening Process

To open an account and start working with this company, you will literally need a few minutes of your time. Just follow this step-by-step scheme:

- Filling out the registration form with your personal information and entering it into the trading dashboard are both required steps in the process of registering with Funding Pips.

- You may select the size of your account by selecting your account.

- When selecting your payment method, you can use a credit or debit card or a cryptocurrency.

- You will be able to access your login credentials for your freshly acquired trading account if you look for an email from Funding Pips that contains a greeting. This email will contain your login and password information.

Payment Methods at Funding Pips Prop Firm

Next in Funding Pips prop firms review is an overview of deposit and withdrawal methods. The cryptocurrency USDT TRC20 will be used to handle payouts of less than $500. Rise will be used to handle payouts more significant than $500. Rise supports both cryptocurrency and bank transfers.

Funding Pips enables traders to make weekly withdrawals, ensuring consistent and convenient access to funds generated from their trading endeavors. This feature is beautiful because it provides consistent payouts, motivating traders to stay focused and maintain their trading momentum.

The weekly payout system not only guarantees that traders can receive their earnings promptly but also aids in their financial planning and reinvestment strategies, improving the overall trading experience on the platform.

Funding Pips enables users to make withdrawals using Deel, a widely used platform for global payments and workforce management.

Customer Support on Funding Pips Company

Funding Pips prop firm offers its loyal clients support and information in order to further their business. The firm has a thorough, frequently asked questions area that is easily accessible in order to give critical information about the company and its assessment program and address typical questions. They have a customer support team that is available to assist you in the event that you require individualized assistance. They may be reached through their various social media outlets, which will allow you to receive a rapid answer. You also have the option of sending them an email at [email protected] to get in touch with them directly.

Conclusion Review and Analysis About Funding Pips Prop Firm

To summarize the Funding Pips review, we note that the company provides a range of pricing options to suit your needs, a wide variety of trading instruments to choose from, a lucrative scaling plan, and the opportunity for generous profit sharing. The pricing options offered by the prop firm are designed to accommodate a diverse array of preferences and budgets, guaranteeing accessibility for traders of every level. The wide range of trading instruments, such as forex pairs, commodities, indices, and cryptocurrencies, accommodates different trading strategies. The scaling strategy and profit-sharing program provided by Funding Pips are specifically crafted to acknowledge and incentivize traders for their hard work and dedication. Weekly payments and endless trading days offer traders extra flexibility and motivation. In addition, the company’s customer service is easily accessible to answer questions and offer assistance. Overall, Funding Pips provides a complete solution for traders seeking to maximize their capital and pursue a path to financial prosperity in the realm of proprietary trading.

FAQs: About Funding Pips Prop Trading Company

Can I sign up for multiple challenges?

You can join numerous challenges; however, the total funded capital can be at most $300,000. There is no way to duplicate transactions (EA or Manual) from a master account to an evaluation account or from one evaluation account to another to pass several challenges with the same trades and concepts. Your preference is to merge the Master/Funded accounts into one or keep them separate after the review.

Does Funding Pips have credibility?

Yes. The company is headquartered in Dubai, UAE. The firm constantly expresses its intention to serve traders well and achieve its goal together.

What's toxic trading flow?

Toxic trading involves irresponsible risk-taking, impulsivity, and disdain for fundamentals. It threatens trader accounts and proprietary trading businesses. Toxic trading will be defined, and the need for awareness and accountability in choosing lucrative trading techniques will be highlighted.

The refund procedure takes how long?

The evaluation challenge refund procedure may take up to 10 business days. You cannot get a refund if you traded during the assessment challenge. Our support team will walk you through the refund procedure by email at [email protected] or live chat.

How do I request a Payout?

Our website dashboard menu includes "Payouts." To seek payment, fill out this form. Filling out this form will put your trading account in view-only status until the payment is finalized, so close all transactions. Payouts start at 1% of the starting sum, including our cut.

Are there minimum or maximum trading days during the evaluation?

The minimum trading day for Funding Pips is three trading days in all models, but solely for evaluation models. The master account has no minimum trading days.