FXIFY: Prop & Cons

Before proceeding to a more detailed analysis of this prop firm, it is essential to highlight its advantages and disadvantages in FXIFY review, because knowledge of them is essential when traders decide to cooperate with the firm:

Pros

- +Impressive Trustpilot Rating of 4.5/5.

- +Providing Assistance to Customers Based in the United States.

- +Three Distinctive Funding Programs.

- +Various Additional Features.

- +Advanced Trader Dashboard.

- +A wide range of trading instruments is available, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

- +Unlimited Trading Duration.

- +Plan for Scaling.

- +Instant Payment Available.

- +Twice a month payments with additional bonus.

- +Earnings Split of 75% to 90%.

- +Trading the news is permitted.

Cons

- -Trading Day Requirements: Minimum of 5 Days.

- -Bi-weekly Payout Cycles (Enhanced with Add-on).

- -Examining the Decrease in Performance during a Single-phase Assessment.

- -Strict 5% Maximum Loss Regulation for Three-phase Assessment.

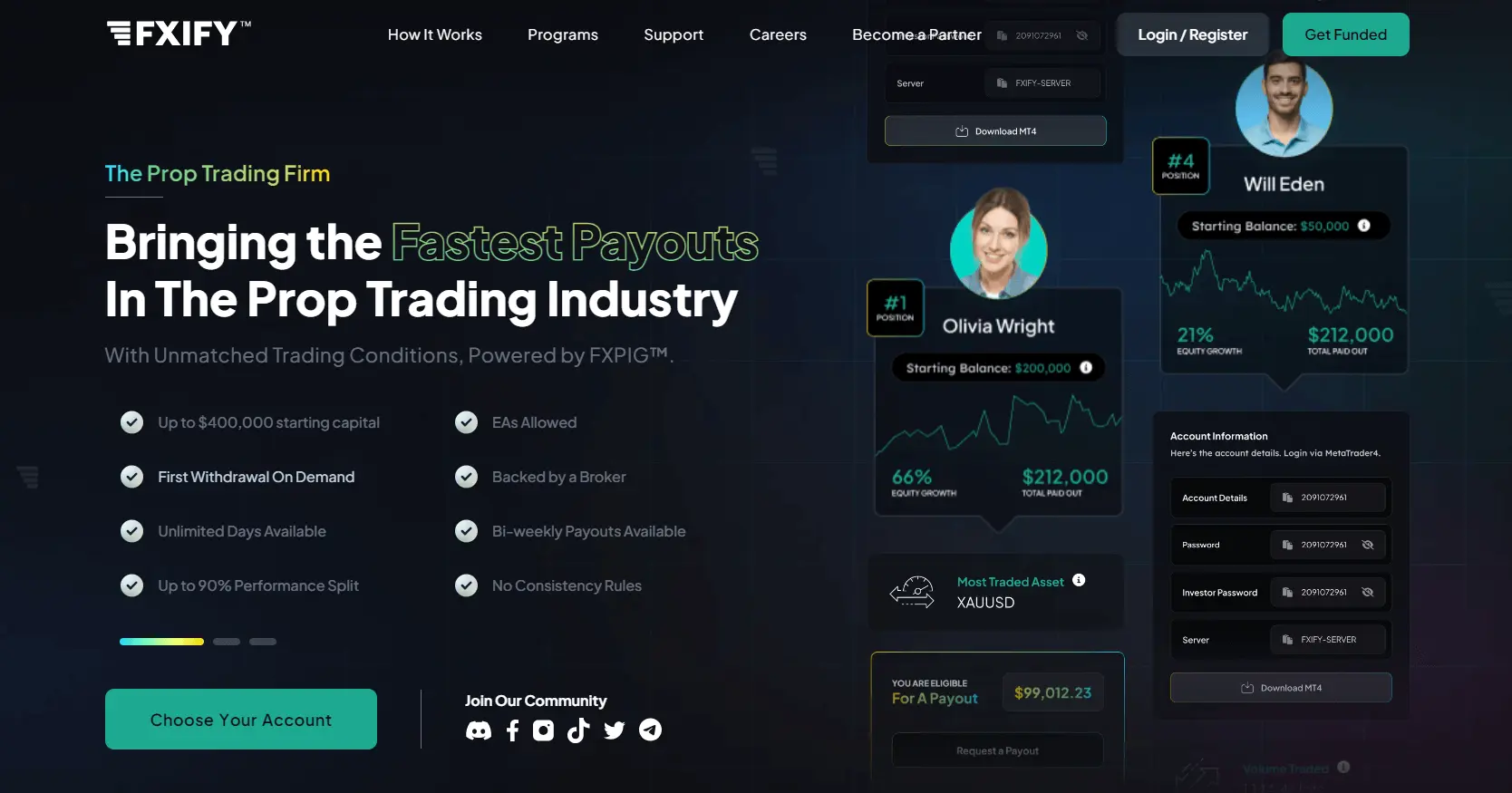

Who is FXIFY Prop Firm?

FXIFY is an exclusive trading firm that provides skilled traders and investors with the opportunity to access up to $400,000 in proprietary funds upon completing a set of trading assessments. Traders have the chance to increase their account size to $4 million while also benefiting from profit-sharing splits that can go as high as 90%. FXIFY prop firm provides two assessment program choices for securing funding, which consist of a One-Phase and Two-Phase series. Every evaluation comes with its own set of distinct terms and conditions, providing traders with increased flexibility to suit their trading requirements. FXIFY prop accounts can be accessed through the widely-used MT4 and MT5 trading platforms, thanks to their collaboration with FXPIG, a reputable retail brokerage that has been operating since 2010.

Traders who utilize FXIFY brokers can benefit from trading without any commission fees on a diverse range of products, such as Forex, Stock Indices, Precious Metals like Gold and Silver, and other options. Traders can also benefit from narrow spreads, without any limitations on trading, and the ability to customize leverage. FXIFY also permits traders to utilize automated strategies and Expert Advisors (EAs) for trading at their prop firm, provided that these strategies are original and exclusively developed by the client. Find out more in our FXIFY review.

Who is the CEO of FXIFY?

David Bhidey and Peter Brown are the visionary minds behind the creation of FXIFY.

David Bhidey, one of the co-founders of FXIFY, boasts an extensive background in technology and e-commerce. He started his journey by establishing an online property company. Due to his deep interest in technology and finance, he decided to venture into the world of trading half a decade ago. He became an Introducing Broker at FXPIG, working closely with Peter Brown. They skillfully maneuvered through the financial markets and achieved success.

Over the last four years, David has perfected his exclusive trading abilities and, together with Peter, founded a prominent proprietary trading company to address a void in the market. With his extensive experience, David is determined to transform FXIFY prop firm into a trader-focused triumph, placing the utmost importance on profitability and maintaining a strong ethical foundation. His forward-thinking perspective drives the company, guaranteeing its continuous innovation and exceptional performance in the financial markets.

Peter Brown, one of the co-founders of FXIFY, has an extensive background in e-commerce and marketing and over ten years of experience. Throughout his digital career, he has gained experience in various agencies, establishing his ventures and taking on leadership roles in performance marketing and website development. After venturing into personal trading half a decade ago, Peter joined forces with David Bhidey to become an Introducing Broker for FXPIG.

Through their partnership, they successfully developed FXIFY, which effectively filled a gap in the market. With Peter’s expert guidance, FXIFY quickly established itself as a leading proprietary trading firm. Peter utilizes his expertise in e-commerce and finance to effectively drive FXIFY’s continuous growth and achievement in development and performance marketing.

FXIFY of Key Features

After carefully considering user feedback, let’s now explore the essential aspects of FXIFY in greater depth.

- Rapid Execution Times: One significant benefit of utilizing FXIFY is its rapid execution speeds. The platform uses cutting-edge technology to guarantee fast and efficient trade execution, minimizing the chances of slippage. This is particularly advantageous for day traders who depend on rapid trades to generate profits.

- Demo Account: For newcomers, FXIFY prop firm provides a trial account that enables users to hone their trading skills without putting any actual funds at stake. This is a fantastic feature for individuals who are new to trading and desire to become acquainted with the platform prior to investing their funds.

- User-Friendly Interface: FXIFY boasts an interface that is incredibly easy to navigate and use. The platform is crafted to be user-friendly and effortless to navigate, making it ideal for traders of all levels, whether they are just starting or have years of experience. The well-structured design and neatly arranged menus ensure effortless access to a wide range of features and financial instruments, resulting in a smooth and hassle-free trading experience.

- Low Fees: When it comes to trading platforms, FXIFY stands out with its competitive fee structure, which is notably lower than that of other platforms. They have a commission fee of 0.1% per trade, which is considerably lower than numerous other platforms available in the market. This makes it a compelling choice for traders seeking to reduce their expenses and optimize their earnings.

- Diverse Selection of Financial Instruments: FXIFY brokers provides a diverse selection of financial instruments, encompassing forex, stocks, commodities, indices, and cryptocurrencies. This enables users to broaden their portfolio and capitalize on various market opportunities. The platform also provides the option for leverage trading, which has the potential to enhance profits but also entails more significant risks.

- Trading on the Go: FXIFY prop firms also provides a mobile trading application, enabling users to trade while on the move. The app can be downloaded on both iOS and Android devices and provides users with all the features found in the desktop version. This is highly convenient for traders who are constantly on the go and desire to stay informed about their trades.

FXIFY: General Information

| Website: | www.fxify.com |

|---|---|

| Date of foundation: | May 2023 |

| Minimum deposit: | $99 |

| Deposit Methods: | Visa, PayPal, BTC |

| Withdrawal Methods: | Rise, BTC, Bank Transfer |

| Leverage: | Up to 1:50 |

| Trading platform: | MetaTrader4, MetaTrader5 |

| Account currency: | USD |

| Spread: | Starting with 0 pip, normal or raw |

| Margin Call / Stop Out: | No |

| Assets: | Bitcoin, gold, stocks, indexes, and currency pairings |

| Brokers: | FXPIG |

| Programmes for Trading: | One-step Challenge, Three-step Challenge, Two-step Challenge |

| Size of the Account: | $10,000, $100,000, $15,000, $200,000, $25,000, $400,000, $50,000 |

Is Reliable & Legal FXIFY Prop Company?

When selecting a trading platform, the dependability factor must be taken into account. Ultimately, your top priority is to guarantee the safety and security of your funds and personal information. Can you provide some information about the reliability of FXIFY?

To address this inquiry, various aspects, such as regulatory policies, security protocols, and user feedback, must be considered.

Legal/Licence

FXIFY is under the supervision of the International Financial Services Commission (IFSC) in Belize. Although Belize may not have the same level of recognition as regulatory bodies such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC), it enforces stringent guidelines that trading platforms must follow. We conduct frequent audits and compliance checks to guarantee that the platform operates with the utmost ethics and transparency.

User Feedback

As we have seen before, FXIFY prop firms has received a variety of responses from users. Although some customers have had excellent experiences, others have encountered difficulties with customer assistance and even platform outages. It is important to keep in mind, however, that no trading platform is flawless and that problems may appear on occasion. Prior to making any judgments, it is necessary to take into account all of the relevant elements and to carry out extensive study.

Reputation

FXIFY has an impeccable reputation, which it has already proved with years of successful work on the market. Only 8% of Trustpilot reviews on Trustpilot relate to complaints about this prop firm, while the rest of our clients are satisfied with its performance.

Safe

FXIFY prioritizes the security of its users’ funds and personal information and has put in place multiple safeguards to ensure their protection. Here are some examples:

- Enhanced security: Users can enable two-factor authentication, which provides an additional level of protection for their accounts.

- FXIFY utilizes state-of-the-art SSL encryption to safeguard user data and communication on the platform.

- Separate accounts: User funds are held in accounts that are kept separate from the company’s operational funds. This guarantees that in the event of any financial challenges faced by FXIFY, users’ funds will remain unaffected.

What Makes FXIFY Different From Other Prop Firms?

FXIFY sets itself apart from other top prop firms by providing three distinct account options: a two-step evaluation, a one-step evaluation, and a three-step evaluation. Moreover, they offer a wide range of advantageous characteristics, including an unlimited trading duration, instant first withdrawal, a plethora of additional features, and raw spread accounts.

FXIFY offers a comprehensive two-phase evaluation process that consists of two distinct steps, which traders must complete in order to qualify for payouts. The desired profit goal for phase one is 10%, which decreases to 5% in phase two. Additionally, there are FXIFY rules in place to limit daily losses to a maximum of 5% and overall losses to a maximum of 10%. Additionally, there are no restrictions on the number of trading days you must meet during either evaluation phase. Nevertheless, it is mandatory to engage in trading for a minimum of 5 consecutive days during each evaluation phase. The Two-phase Evaluation also offers a one-of-a-kind scaling strategy, enabling traders to handle account sizes of any magnitude effectively. In comparison to other funding programs in the industry, the Two-phase Evaluation program distinguishes itself by offering an indefinite trading period, immediate withdrawal upon request, a wide range of additional features, and raw spread accounts.

FXIFY’s One-phase Evaluation is a streamlined assessment process that traders must complete in order to become eligible for payouts. The desired profit goal is set at 10%, accompanied by strict rules that limit daily losses to a maximum of 5% and trailing losses to a maximum of 6%. Additionally, there are no restrictions on the number of trading days you can have during the evaluation phase. Nevertheless, it is mandatory to engage in trading for a minimum of 5 consecutive days during the evaluation phase. It’s important to note that the One-phase Evaluation also offers a one-of-a-kind scaling plan, which enables traders to handle larger account sizes effectively. In comparison to other funding programs in the industry, the One-phase Evaluation program is notable for its unlimited trading period, the ability to withdraw funds whenever needed, a wide range of additional features, and the availability of raw spread accounts.

FXIFY prop trading firm offers a comprehensive three-phase evaluation process that consists of three distinct steps that traders must complete in order to become eligible for payouts. The desired profit margin for each phase is consistent at 5% while adhering to a maximum daily gain and loss limit of 5%. There are no set limits on the number of trading days you need to complete during each evaluation phase. Nevertheless, it is mandatory to engage in trading for a minimum of 5 calendar days during every evaluation phase. The Three-phase Evaluation also offers a one-of-a-kind scaling plan, enabling traders to handle even larger account sizes effectively. In comparison to other funding programs in the industry, the Three-phase Evaluation program distinguishes itself by offering an indefinite trading period, immediate withdrawal upon request, a wide range of additional features, and raw spread accounts.

FXIFY brokers stands out from other top prop firms with its range of distinctive account options. Traders can choose between a two-step evaluation, a one-step evaluation, or a three-step evaluation. Moreover, they offer a wide range of advantageous characteristics, including an unlimited trading duration, instant first withdrawal, a plethora of additional functionalities, and raw spread accounts.

FXIFY: Challenge Funding Program Options

Now in the FXIFY brokers review, let’s explore the details of the FXIFY assessment, which includes a one-phase and two-phase component. First, you choose the amount you want to deposit initially, which can be anywhere between $25,000 and $400,000, depending on your goals.

1-Phase Challenge

In the initial assessment phase, the objective is to reach a profit goal of 10% within a 30-day timeframe. Traders can choose to eliminate the time restriction during the checkout process if they wish.

To manage risks, there is a daily limit of 5% for losses on all deposit amounts. Make sure to adhere to this restriction during a single day of trading. The daily loss limit is determined by the balance at the end of the previous day, precisely at 5 p.m. EST.

A notable distinction between the evaluation processes of 1-phase and 2-phase is the varying drawdown requirements. Although the 2-phase evaluation has a fixed drawdown limit of 10%, the 1-phase evaluation uses a trailing drawdown limit of 6%. This implies that your account balance is safeguarded from dropping more than 6% from its peak value once it surpasses a new highest balance. This rule protects your investment and mitigates the risk of substantial losses.

The FXIFY prop trading firm Evaluation must be conducted for a minimum of 5 trading days before it can be finalized. The one-phase assessment establishes a profit goal that must be reached within 30 trading days. Still, traders have the option to eliminate the time constraint at checkout, enabling an unlimited number of trading days.

Throughout the initial assessment, a leverage ratio of 30:1 is typically provided. During checkout, traders have the option to enhance their leverage for forex and gold trades up to 50:1.

2-Phase Challenge

Now, let’s delve into the evaluation process, which has two distinct phases. The profit goal remains at 10%; however, the second phase has a lower profit target of 5% and a maximum trading day limit of 60.

The evaluation process consists of two phases and has a fixed limit of 10% for drawdown. This ensures that your account balance will stay within 10% of its peak, even if a new peak balance is achieved. This rule offers versatility, permitting slightly more significant decreases in the account balance.

After completing the evaluation, FXIFY will carefully examine your documents using Sumsub to authenticate your identity (KYC). Upon approval, you will be extended an invitation to sign a Trader Agreement in the capacity of an independent contractor. Afterward, you will be provided with the necessary information to access your funded account and begin trading.

FXIFY has formed a collaboration with Deel, a company that manages trader agreements and facilitates profit withdrawals. Once you complete the evaluation, Deel will send you an email containing detailed instructions on how to access and finalize your Trader Agreement. Once you have completed the agreement and submitted the necessary KYC documents, your account will be established, funded, and issued within 24-48 business hours.

After completing both evaluation stages, you will be qualified for reimbursement. This refund is issued when you initiate your initial withdrawal. You will be given a complete reimbursement of your purchase expense along with an additional 25% as an added incentive, resulting in a total of 125% of the refund.

3-Phase Challenge

In the third evaluation phase, traders must achieve a profit target of 5% without exceeding their 5% maximum daily loss or 5% maximum loss rules. Regarding time constraints, it’s important to mention that there are no specific restrictions on the maximum number of trading days in phase three. Nevertheless, you must engage in at least five trading days before you can move forward with a funded account.

The Three-phase Evaluation also includes a plan for scaling. Suppose a trader manages to generate consistent profits in at least two out of the last three months, with an impressive average return of 10% over the three months. In that case, they will qualify for a significant increase in their account size, equivalent to 25% of their initial account size.

Here’s an example:

- After three months, a qualified account with an initial balance of $100,000 has grown to $125,000.

- Following the next three months, a qualified account of $125,000 will grow to $150,000.

- Following the next three months, a qualified account of $150,000 will grow to $175,000.

- And so forth…

Assessment of Trading Guidelines and Goals in Three Phases

- Profit Goal – Traders need to reach a specified profit percentage in order to complete an evaluation phase, withdraw earnings, or expand their trading account. The profit goal for Phase 1, Phase 2, and Phase 3 necessitates achieving a profit target of 5%. Funded accounts do not have any specific goals for generating profits.

- Maximum Daily Loss – The trader’s predetermined limit on the amount they can lose in a single trading day without exceeding their account’s threshold. Every account, regardless of its size, has a cap on the amount it can lose in a single day, which is set at 5%.

- Maximum Loss – The trader’s allowable limit for overall losses without exceeding the account balance. Every account size has a cap on potential losses at 5%.

- Trading Duration Requirement – The minimum period in which you must actively participate in trading before completing an evaluation phase. All three evaluation phases must be conducted for a minimum of 5 trading days.

Challenge Scaling Plan

The scaling plan operates as follows: To scale up by 25%, the trader must achieve a 10% increase in the first three months, with two of those three months being profitable. After that, scaling up will occur every three months, and the account amount will double.

In order to accommodate accounts of any size, the scaling approach is as follows:

- In order to scale up by 25%, the trader has to generate a return of 10% during the first three months, with at least two of those months being successful. The trader will be required to earn a return of at least 10% and to have at least two out of every three months be successful in order to be eligible for subsequent scaling, which will take place every three months. With each scaling up, the account balance will increase by a factor of two.

- For instance, if you had 400 thousand accounts in three months, you would scale up by 25 percent, which would get you to 500 thousand. Following that, the number of accounts would be increased every three months.

Profit Splits

The performance split that is normal for FXIFY is 75%.

Which Broker Does FXIFY Use?

Next up in the FXIFY prop firms review, let’s take a look at which broker the prop firm uses. FXIFY brokers, in partnership with FXPIG, a well-established broker since 2010, offers a one-of-a-kind prop firm experience by delivering all the necessary tools commonly anticipated from a standard broker. Traders have the option to trade using the highly acclaimed MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, which are backed by a reputable multi-asset Tier 1 actual STP broker. This guarantees a superior trading environment for optimal results.

Trading Instruments

FXIFY offers traders a wide range of trading instruments, encompassing more than 300 options. These include stocks, cryptocurrencies, indices, and forex, providing ample opportunities for diversification and exploration. This wide range of options is perfect for traders with different preferences, giving them the opportunity to explore a variety of markets.

A standout aspect of FXIFY is its trading without any commissions for forex, gold/metals, and indices. This unique offering removes any extra expenses usually linked to these assets, enabling traders to enhance their trading performance. In addition, traders have the option to engage in stock and cryptocurrency trading, broadening their investment possibilities on a single platform.

Trading Platforms

Market participants have the option of selecting either the MetaTrader 4 or the MetaTrader 5 trading platform. It is not possible to obtain alternative software, which is a limitation that may be regarded as a relative disadvantage.

Trading Fees

FXIFY offers a range of pricing options based on the initial investment amount, starting from $175 and going up to $1,999. This pricing flexibility guarantees that traders with varying budgets and trading styles can discover a suitable choice.

The evaluation account’s setup and maintenance are included in the assessment fee. Traders who are successful but fail to reach their goal will not incur a reset fee. If individuals do not pass the assessment, they are given the chance to retake it at a reduced cost of 10%. This provides an opportunity for growth and progress, all while ensuring a reasonable fee arrangement.

FXIFY provides a profit-sharing arrangement that commences at 75% and can be enhanced by 15% to reach 90% by acquiring an additional feature during the checkout process. Opting for a more lucrative profit distribution entails an extra cost equivalent to 20% of the standard fee. Traders also have the option to select between receiving payouts every two weeks or sticking to the regular monthly payout schedule. Traders can also receive their earnings more frequently by paying an additional 5% fee.

FXIFY’s additional features offer traders the freedom to customize their accounts to align with their unique trading styles and preferences perfectly. As an example, traders have the option to enhance their leverage by paying an additional 25%, granting them the ability to utilize leverage of up to 50:1 for forex and gold trading. This improved level of leverage expands the scope of possibilities for optimizing trades. Traders have the option to extend the evaluation period for an indefinite number of days by paying a small fee of 5%. This allows them to showcase their abilities and meet evaluation targets at their own preferred pace.

FXIFY: Step-by-Step Account Opening Process

In order to begin your journey with a prop-trading company, you must complete the registration process on their official website. After that, you will need to verify your identity, select the appropriate account type and the desired balance, and finally, make the payment for the startup fee. Following that, you have the option to download the trading platform and commence the Challenge. Here is a detailed guide that will walk you through each step. Specialists at TU also outline the characteristics of the user account.

- Navigate to the company’s website and locate the “Client Area” option in the top right corner. Alternatively, you may choose to select “Open Account.”

- If you possess login credentials, kindly input your username and password. Alternatively, select “Sign Up.”

- Provide your name, email address, and preferred nickname. Set and verify your password. Please indicate your acceptance of the collaboration terms by selecting the checkbox. Please select the “Sign Up” option.

- Review your email for a confirmation message. Please click on the link provided to activate your account.

- To initiate a new challenge, click on the “Start a New Challenge” option in the upper left corner of your user account.

- Select the type of account and the balance you desire. Please indicate the trading platform you intend to utilize and choose the kind of spread and other account settings.

- Provide your registered address. Please provide any discount or referral codes, if applicable. Indicate your acceptance of the terms by selecting the checkbox on the right. Please choose the option “Proceed to Payment.”

- Select the payment method, input the necessary information, and click on “Pay Invoice.” Please await confirmation of payment. Now, download the MT4 or MT5 trading platform, input your registration information, and embark on the exciting Challenge. After successfully finishing, you’ll be granted an authentic account with the designated balance for trading.

Payment Methods at FXIFY Prop Firm

Clients are free to initiate the first funds withdrawal whenever they have completed the Challenge. Subsequently, payments are handled biweekly.

Traders can choose to withdraw their profits to a variety of options, including a bank account, bank card, electronic wallet, or cryptocurrency wallet.

Customer Support on FXIFY Company

FXIFY provides various channels through which account holders can contact their customer service team.

- Contact via Email: FXIFY suggests that users reach out to its customer service team via email for any general inquiries. If you wish to contact FXIFY via email, kindly send your inquiries to support@fxify.com. You can also fill out a contact request form here, and a representative will get in touch with you. The company’s email inbox is under constant surveillance from 4 a.m. to 1 p.m. EST.

- To get in touch with FXIFY via live chat, click on the speech bubble button located in the bottom right corner of the firm’s homepage. Similar to email, live chat is closely monitored from 4 a.m. to 1 p.m. EST.

Although the trading hours may not be convenient for traders in the United States, the customer service professionals provided accurate and prompt responses when we contacted them. FXIFY intends to expand its workforce both in the United States and internationally in order to offer round-the-clock customer support to its proprietary traders.

Conclusion Review and Analysis About FXIFY Prop Firm

Ultimately, FXIFY revolutionizes the prop trading sector by providing tailor-made funding programs, adaptable trading regulations, and the opportunity to trade a diverse array of assets. FXIFY is dedicated to creating a nurturing and open atmosphere with the goal of assisting ambitious traders in achieving unprecedented success in their professional journeys.

Whether you opt for the one-phase or two-phase assessment, FXIFY provides customized choices that cater to various levels of expertise and risk tolerance. The clear and straightforward fee system and additional options enable traders to personalize their accounts and maximize their potential for earnings. By offering trading without commissions and a wide range of tradable assets, traders can easily explore different markets all in one platform.

In addition, FXIFY offers flexible trading regulations that grant traders the freedom to utilize EAs and keep trades open during the weekend. This allows traders to execute their strategies and adhere to their personal preferences.

To summarize, FXIFY is a unique prop trading firm that distinguishes itself by providing traders with a wide range of resources and assistance to help them achieve success. If you are a driven trader seeking a prop firm to elevate your career, FXIFY could be an ideal partner for you.

FAQs: About FXIFY Prop Trading Company

Is copy trading allowed?

Yes, you may duplicate transactions between FXIFY accounts and others.

Before copying transactions from other accounts to FXIFY, you must provide us with an HTML copy of the master trading account statement. Copying from outside parties violates our terms and conditions.

What happens if you lose money in a prop firm?

If they frequently lose more than agreed-upon limitations, traders may be suspended or fired.

What is the profit split on FXIFY?

The standard FXIFY performance split is 75%.

How does your scaling plan work?

To scale up 25%, traders must reach 10% in the first three months and profit in two of them. After scaling up, the account balance doubles every three months.

Which broker does FXIFY use?

FXIFY operates with FXPIG as its broker, accepting cryptocurrencies and cards. Deel and cryptocurrencies allow withdrawals. The platform enables copy trading, hedging, and EAs but not HFT.

What is the maximum funding for FXIFY?

From $15,000 to $400,000. FXIFY traders can take on various tasks.

Transform Your Skills into Real Capital. Seize this Discount XDXV41S to achieve financial success and make your trading passion profitable today!

Transform Your Skills into Real Capital. Seize this Discount XDXV41S to achieve financial success and make your trading passion profitable today!