Nova Funding: Pros & Cons

Before getting to know the Nova funding prop firm in more detail, it is imperative to consider all the advantages and disadvantages. Our Nova funding prop firm review will discuss this further.

Pros

- +Flexible Nova Funding Forex Trading allows traders to customize their trading experience according to their preferences. Traders enjoy the flexibility of an unrestricted calendar window, allowing them to plan and execute trades without being bound by inflexible time limits.

- +Accelerated Advancement: Completing the Nova Funding challenge opens up fast-track opportunities for progression. In just 72 hours, traders make a rapid transition to becoming seasoned traders, unlocking the opportunity to trade with commission-eligible paper funds and broadening their horizons in the forex market.

- +Skill Enhancement: Nova Funding Forex Trading is a valuable platform for honing your skills. It offers traders the opportunity to gain practical experience and tackle real-life challenges. During these demanding challenges, traders enhance their analytical skills, fine-tune their risk management strategies, and develop the necessary discipline for achieving success in forex trading.

Cons

- -Nova Funding's strict drawdown limitations may surprise traders who are used to more freedom, but they promote intelligent risk management. Limiting daily losses at 4% and total drawdown to 8% might limit trading methods and profitability.

- -Performance strain: A 10% profit objective within parameters might put traders under strain. Pressure to perform may increase stress and impair traders' decision-making, lowering trading performance.

Who is Nova Funding Prop Firm?

Nova Funding is a well-respected prop trading service that provides financial market participants with a complete platform on which they may demonstrate their expertise in the financial markets. They have established themselves as a trustworthy prop business and have been a favorite among many members of the trading community thanks to rewards totaling more than ten million dollars more.

Nova Investment is dedicated to enabling global traders. As part of this mission, the company offers individuals the chance to exhibit their trading ability and qualify for considerable investment, depending on their performance. The company takes great pleasure in its user-friendly interface, which provides access to a variety of trading products, including foreign exchange and cryptocurrency. Nova Funding is committed to fostering the growth of traders by delivering ample cash, sophisticated trading tools, and instructional materials for individual traders with varying degrees of expertise.

Nova Funding is an enticing alternative for traders who are trying to improve their trading efforts and achieve financial success inside financed trading prop businesses. Since the company places a b emphasis on community support and personalized instruction, it is an attractive choice. Nova Funded makes use of a simulated trading environment through which users have the opportunity to earn commissions that may reach up to 80 percent of the earnings achieved!

Nova Funding: Key Features

While Nova’s Funding rules may seem rigid, this company has the features that make it the number one choice for many traders. This means that in our nova funding prop firms review, it is time to look at the key features of this company:

- Quickness and Adaptability: Nova Funding Forex is known for its efficient account access, delivering funded accounts in just 72 hours.

- Unlimited Trading Freedom: Nova Funding allows traders to have the flexibility to utilize a wide range of trading systems, such as news trading, expert advisors, and manual trading.

- Trading with a Fun Twist: Nova Funding presents a trader leaderboard where exceptional performers can unlock enhanced profit splits and more frequent payouts. The top earners are prominently showcased on the website, which adds another notable aspect.

- Various Assessment Strategies: Nova Funding provides a variety of evaluation plans with different profit targets, drawdown limits, and pricing options to suit your needs. The leverage ratio of 1:100 is maintained consistently across all plans.

- Clear and straightforward payment procedure: Payments are effortlessly processed using cryptocurrency, demonstrating a forward-thinking approach that aligns with the increasing fascination with the world of digital currency. Nova Funding ensures that payouts are processed within a timeframe of 24-72 hours.

- Transparent Dashboard: Nova Funding provides a transparent and enlightening dashboard that allows traders to track their current trading performance.

Who is the CEO of Nova Funding?

No information about the CEO of this company could be found, which is not the most positive point and should be taken into account when deciding whether to cooperate with it.

Nova Funding: General Information

| Official Website: | https://nova-funding.com/ |

|---|---|

| Max Allocation: | $200,000 |

| Phase 1 and 2 Profit Target: | 10% |

| Profit Split: | Up to 80% |

| Broker: | DX Trade |

| Drawdown limits: | 4% daily and 8% total |

| Trading Platforms: | MetaTrader4 & MetaTrader5 |

| Deposit and withdrawal methods: | Crypto |

| Free Trials: | There are no free trials available |

| Support: | [email protected] – Support accessible around the clock (live chat from 6 a.m. to 6 p.m. CDT) |

Is Nova Funding a Reliable & Legal Prop Company?

Very often, any terms and conditions offered by a company are unimportant if they cannot be trusted. So, right now, in our Nova Funding review, we will look at this firm’s legality and reliability.

- Legal/Licence: The Nova Funding company is registered in the U.S. at 8911 N Capital of Texas Hwy Ste 4200-305, Austin, TX 78759-7247. ABN 71 661 045 950. No license information is available.

- Reputation: Among the 279 reviews that have been posted on Trustpilot, the Nova Legal Funding website has received a rating of 4.9 out of a possible 5.0. Remarkably, this is the average! Problems with customer service or reports that loans were denied are the subject of the few complaints that were discovered there.

- Safe: Customer reviews indicate that this company is secure. The firm itself provides security to its clients with the most advanced encryption, two-factor identification, and other means.

What Makes Nova Funding Different From Other Prop Firms?

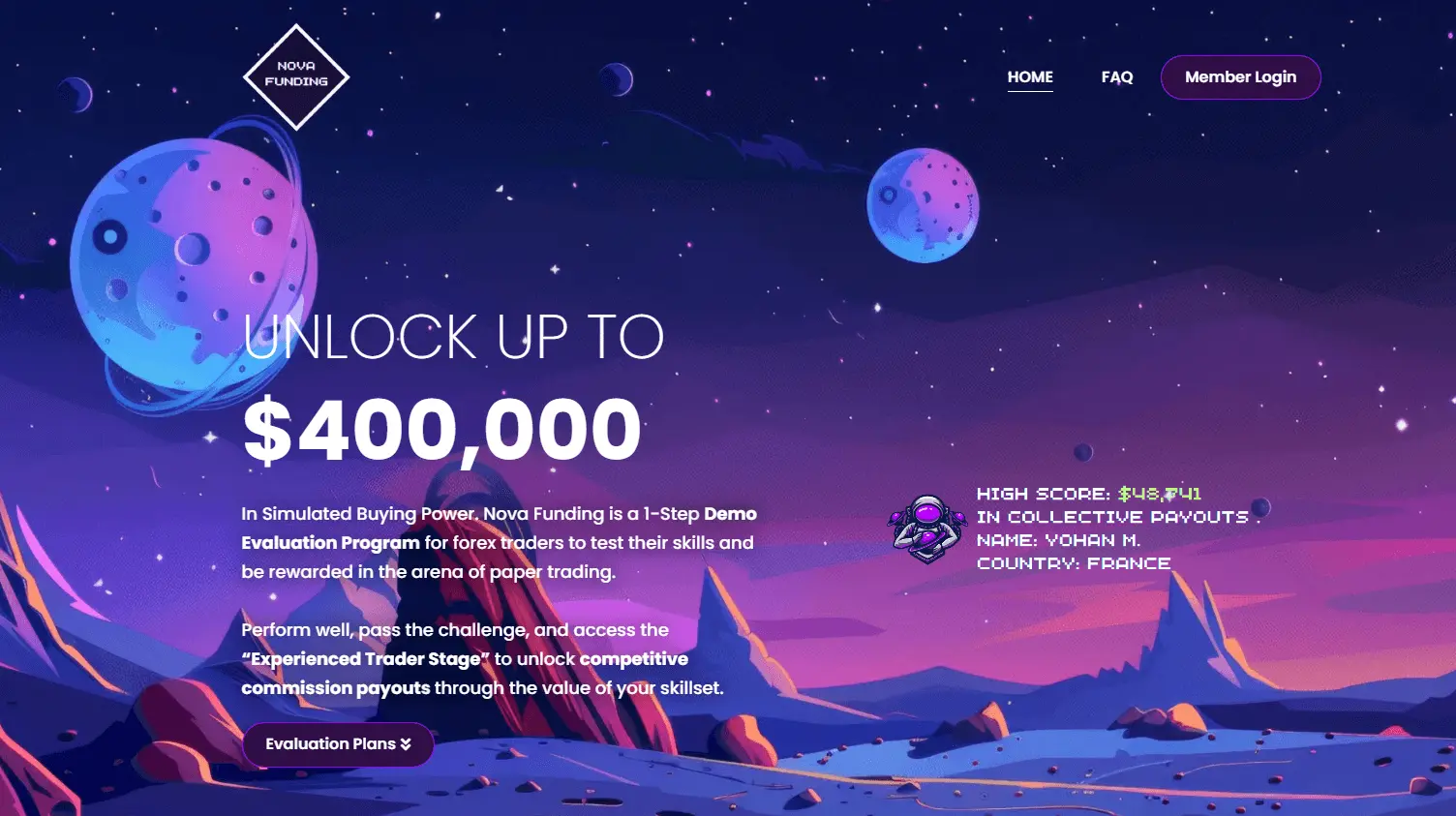

Following the successful completion of the appraisal step, Nova Funding distinguishes itself by enabling traders to gain access to a collective simulated buying power of up to $400,000 within seventy-two hours. This unlocked the opportunity to get commissions based on your success, providing you with even more motivation to perform exceptionally well throughout your trading adventure.

Nova Funding: Challenge Funding Program Options

The main advantage of this prop firm’s program is its maximum simplicity. Everything here is clear even to a beginner, and right now, as you read further Nova funding brokers’ reviews, you will be convinced of this.

The Training Grounds

You will be provided with a trial account that has an infinite number of calendar days, allowing you to achieve a profit objective of 10% while still adhering to the limits of 4% daily drawdown and 8% total drawdown.

Either pass in ten days or pass in two hours; the decision is entirely up to you. The potential to trade commission-eligible paper trading funds in as little as three days will be unlocked and made possible by this program, which is designed with speed in mind.

Virtual Funded Account

After you have completed the challenge, you will be able to access a simulated account. This account will allow you to demonstrate your trading approach in a simulated environment while also providing you with a commission.

You will begin with a fifty percent performance commission, and if you demonstrate your trading performance at this stage, you will be entitled to up to eighty percent of the commission on simulated transaction data.

As you continue to develop with us, you will have the opportunity to receive biweekly commission payouts. A paper trading account that is eligible for commissions is said to be at the experienced trader level.

Payments are processed through the use of cryptocurrency. A total payout of more than $25,000,000.

Profit Splits

Despite the fact that Nova Funding has a lower beginning point, the maximum profit share that may be achieved is 80%. Despite the fact that 80% is still a very respectable profit share, other well-known and dependable prop organizations offer payouts of 85% or more, and the company definitely needs to improve in this particular area. The first payment trader is eligible for a start bonus of fifty percent, which may be increased to seventy percent on the second withdrawal, and the maximum bonus for all subsequent withdrawals is eighty percent.

Which Broker Does Nova Funding Use?

DXTrade provides brokerage services, a well-known company with an impeccable reputation that offers clients a wide range of trading opportunities.

Trading Instruments

The company offers its clients the opportunity to trade almost all existing trading instruments, including cryptocurrencies, currency pairs, indices, commodities, and more.

Trading Platforms

Through the Foreign Exchange Clearing House, which is a clearing platform and not a licensed broker, Nova Funding gives its customers access to advanced trading platforms such as MetaTrader 4 and MetaTrader 5. The company allows traders to employ a wide variety of trading techniques and EAs, enabling them to make highly effective use of both sophisticated platform features.

Trading Fees

The spreads are raw, which means that they are deficient, which results in scalping tactics being successful.

There is currently no free trial available for Nova financing because all of the accounts incur costs that vary according to the quantity of virtual funding that is being used. Due to the fact that traders will be required to begin over if they violate any restriction, it is currently not feasible to receive free repeats from Nova Funding. This is a list of the one-time costs that are associated with each funding option that the company provides:

- 25,000 USD – 297 USD

- 50,000 USD – 397 USD

- 100,000 USD – 597 USD

- 200,000 USD – 997 USD

Is Reliable & Legal Funding Pips Prop Company?

Funding Pips has garnered a reputation as a reputable prop trading firm, evidenced by numerous positive reviews and user feedback. Customers have expressed satisfaction on platforms such as Trustpilot, highlighting seamless experiences, excellent trading conditions, and reliable support from the company. Despite a few setbacks in the review, KYC, and onboarding procedures following phase 2, the general attitude towards Funding Pips remains optimistic.

Legal/Licence

Funding Pips is a trustworthy funding platform that links entrepreneurs and small business owners with prospective investors. The company has a comprehensive screening procedure for both investors and businesses, ensuring that all parties involved are reliable. In addition, Funding Pips provides a range of resources and assistance to aid businesses in their growth and success, making it an invaluable asset for those in search of funding.

Reputation

To date, not a single serious case has been identified that would negatively affect the company’s impeccable reputation in customers’ eyes.

Safe

Every day, the company invests in modern data encryption technologies and other methods to protect clients’ information and funds. That’s why, with this firm, you can fully concentrate on trading without worrying about security.

What Makes Funding Pips Different From Other Prop Firms?

Funding Pips sets itself apart by offering a wide range of options to cater to individual trading preferences. Traders at Funding Pips have the opportunity to engage in trading activities during significant news events and maintain open positions overnight and even throughout weekends. However, the use of martingale or hedging strategies is not allowed, and traders with funded accounts are required to establish a stop-loss within the first 30 seconds of a trade.

Funding Pips provides traders with a profit split that varies between 80% and 90% by collaborating with Black Bull Markets.

In contrast to other similar platforms, Funding Pips provides traders with a unique two-stage evaluation process to determine their eligibility for payouts. In the initial stage, the aim is to reach a profit target of 8%, which will then be followed by a shift to a 5% target in the subsequent phase. Both stages have a maximum daily loss threshold of 5% and an overall cap of 10% for total losses. There are no set limits on the number of trading days required in either evaluation phase. The evaluation programs at Funding Pips include:

- A growth strategy.

- Offering achievable profit goals without strict day trading limits.

- Providing clear trading guidelines.

Funding Pips: Challenge Funding Program Options

Funding Pips offers traders three distinct funding program choices:

- Two-step Evaluation

- One-step Evaluation

- Three-step Evaluation

Two-step Evaluation

The Funding Pips Two-step Evaluation offers traders the chance to control account sizes ranging from $5,000 to $100,000. The goal is to find skilled traders who are successful and can effectively handle risk during the two-step evaluation process. The Two-step Evaluation enables you to engage in trading with leverage of up to 1:100.

- Size of the Account

- Price

- $5,000: $36

- $10,000: $66

- $25,000: $156

- $50,000: $266

- $100,000: $444

In the first evaluation phase, traders must achieve an 8% profit target without exceeding their 5% maximum daily loss or 10% maximum loss regulations.

Regarding time constraints, it’s important to mention that there are no specific minimum or maximum trading day obligations in phase one. To move on to the next stage, all you need to do is achieve the 8% profit goal without surpassing the daily or overall loss limits.

In the second evaluation phase, traders must achieve a profit goal of 5% without exceeding their maximum daily loss of 5% or maximum loss limit of 10%. Regarding time restrictions, please be aware that there are no specific minimum or maximum trading day obligations in phase two. To achieve funded status, all you need to do is meet the 5% profit goal without exceeding the daily maximum or maximum loss limits.

After completing both evaluation phases, you will be granted a funded account with a minimum withdrawal threshold of 1% of your initial account balance. You must adhere to the guidelines of the 5% daily loss limit and the 10% maximum loss rule.

You can request your initial payout from your funded account once you generate a profit on the first Tuesday. Subsequently, you can also request payouts every Tuesday, provided that you meet all the requirements. You will receive a profit split ranging from 80% to 90%, depending on the profit generated from your funded account.

Two-step Evaluation Scaling Plan

Two-step Evaluation also includes a plan for scaling up. You will be granted an account boost along with increases in daily and maximum drawdowns, which will be determined by the number of payouts you successfully qualify for and the profit you have earned while being funded.

Nova Funding: Step-by-Step Account Opening Process

To join Nova Funding prop trading firm, you first need to open an account. To do this, follow the following sequence of actions:

- Go to the official website of the company.

- Click the Get Funded button in the upper right corner of the main page.

- You will be asked to choose the most suitable program.

- Compare all the terms and conditions and click on the Start button.

- In the opened window, select the appropriate account size from 25,000 to 200,000 dollars.

- Click on Complete Order.

- In the opened window, specify all data and passwords.

Payment Methods at Nova Funding Prop Firm

All payments and withdrawals are processed using cryptocurrencies that support the currencies in question, such as Bitcoin (Bitcoin Network) or USD-T (ERC-20 Network). Compared to other well-known companies, the time it takes to withdraw money might range anywhere from one to five working days. With that being said, accounts may be acquired using BTC, USDT, ETH, or USDC.

Customer Support on Nova Funding Company

Live chat and email channels are the sole forms of service that Nova Funding provides. The fact that the website and support options are only available in the English language is another disadvantage of the service. Currently, there are no other assistance methods accessible; nevertheless, the live chat feature is often sufficient for most situations. Prop traders are able to search for any topic and receive answers to all of their basic inquiries using the live chat feature of Nova Funding, which has an integrated help center and a frequently asked questions section with a search bar.

Conclusion Review and Analysis Of Nova Funding Prop Firm

Nova Funding is an excellent option for traders who want to delve into the exciting realm of high-stakes forex trading. During this investigation, we have discovered various possibilities and obstacles that come with being involved in Nova Funding. Although the platform provides flexibility, traders must navigate through strict drawdown parameters, the pressure to perform, and uncertainty in regulations. However, they can also benefit from rapid progression and opportunities to enhance their skills.

When traders consider their decision to join Nova Funding, it is crucial to approach this opportunity with thoughtful deliberation and meticulous strategizing. By utilizing the platform’s adaptability to their benefit, mastering risk management strategies, and adhering to a disciplined trading approach, traders can overcome the obstacles presented by Nova Funding and position themselves for triumph.

Moreover, traders must stay alert, constantly adjusting to market conditions and staying up-to-date on regulatory changes. Although Nova Funding may seem appealing, it does come with certain risks that need to be considered. Traders should carefully consider the possible benefits and drawbacks before making well-informed choices regarding their involvement in the platform.

Ultimately, Nova Funding provides traders with an opportunity to showcase their abilities, strive for financial prosperity, and broaden their perspectives within the forex market. By embracing the possibilities offered by Nova Funding while staying aware of its obstacles, traders can confidently and resiliently navigate this ever-changing environment, positioning themselves for success in their trading pursuits.

FAQs: About Nova Funding Prop Trading Company

Is Nova Funding a good prop firm?

Nova Funding is a typical company with a straightforward strategy. It exclusively provides virtual-funded accounts and exclusively accepts cryptocurrencies.

Can I engage in mobile trading with Nova Funding?

Indeed, the company offers mobile versions of both MT4 and MT5 for all types of mobile devices, including Android and iOS.

Nova Funding: How to Begin?

Scroll to "Paper-Trading Evaluations" to start your task. Website section: Unlock up to 200k in commission-eligible buying power.

Choose "Start" beneath the program variation you choose.

Visit the account creation page. Our website login details will be provided to you after the account is created. You may then sign in and buy your assessment. Our system promptly emails your account credentials when you purchase your assessment.

How Long Does The Evaluation Stage Last?

Each trader has limitless time to pass the test. After meeting the 10% profit objective, you can upgrade to your "experienced trader" commission-eligible paper trading account in one trading day. The evaluation lasts as long as your trading plan allows.

How Is Drawdown Calculated?

The 4% Max Daily Drawdown starts with your initial account value at reset time before any transactions are made.

It restarts daily at 00:00 PM Market Watch Time. (5:00 PM EST).

Second, the most significant equity point calculates this statistic.

Avoid going 4% below the reset balance or the most significant equity point in one day.

How Much Leverage Is Offered?

All evaluation accounts have 1:100 base leverage. Experienced trader/funded leverage is 1:30.

Before starting the program, check the simulated pricing provider's contract size because all paper trading accounts will have different margin amounts for various products.